table of contents

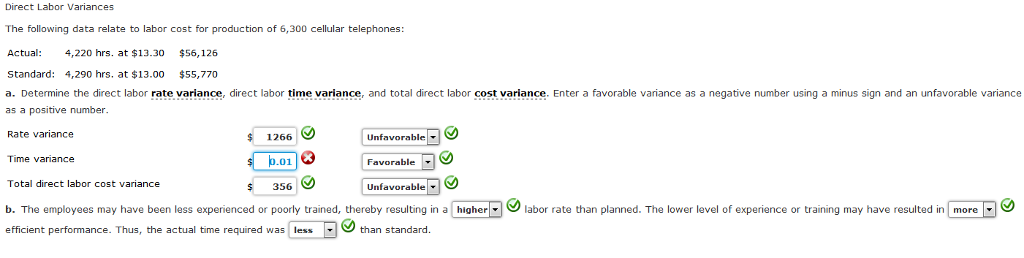

Because Band made 1,000 cases of books this year, employees should have worked 4,000 hours (1,000 cases x 4 hours per case). However, employees actually worked 3,600 hours, for which they were paid an average of $13 per hour. Direct Labor Rate Variance is the measure of difference between the actual cost of direct labor and the standard cost of direct labor utilized during a period. A direct labor variance is caused by differences in either wage rates or hours worked. As with direct materials variances, you can use either formulas or a diagram to compute direct labor variances.

Reasons of Unfavorable Labor Rate Variance:

Overtime payments often come with premium rates that exceed the standard hourly rate. If more overtime is worked than initially planned, the actual hourly rate will be higher, contributing to a labor rate variance. Comprehensively understanding and managing direct labor variance is essential for maintaining cost control, improving operational efficiency, and enhancing overall profitability.

How Time Tracking Software Can Help Optimize Direct Labor Efficiency

Enter the actual hours worked, the actual rate paid, and the standard rate pay into the calculator to determine the labor rate variance. All tasks do not require equally skilled workers; some tasks are more complicated and require more experienced workers than others. This general fact should be kept in mind while assigning tasks to available work force. If the tasks that are not so complicated are assigned to very experienced workers, an unfavorable labor rate variance may be the result.

Direct labor efficiency variance

This is offset by a larger favorable direct labor rate variance of $2,550. The net direct labor cost variance is still $1,550 (favorable), but this additional analysis shows how the time and rate differences contributed to the overall variance. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product.

Direct Labor: Standard Cost, Rate Variance, Efficiency Variance

Ultimately, understanding and managing labor variances are essential for maintaining financial health and operational efficiency. If the actual hours worked are less than the standard hours at the actual production output level, the variance will be a favorable variance. A favorable outcome means you used fewer hours than anticipated to make the actual number of production units. If, however, the actual hours worked are greater than the standard hours at the actual production output level, the variance will be unfavorable. An unfavorable outcome means you used more hours than anticipated to make the actual number of production units. If the actual rate of pay per hour is less than the standard rate of pay per hour, the variance will be a favorable variance.

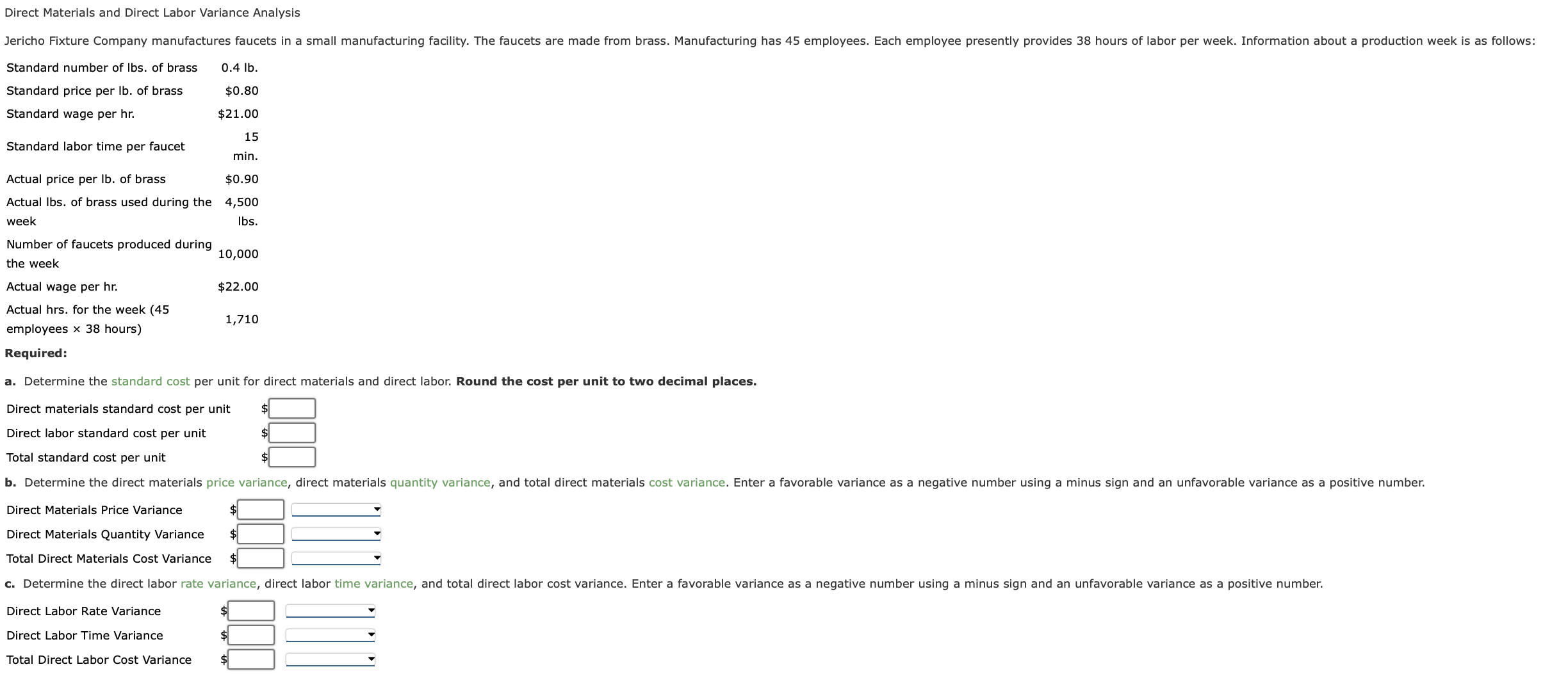

3: Direct Labor Cost Variance

On the other hand, if tasks are completed faster than expected, your project will be considered more labor-efficient, decreasing the costs. Monitoring this variance enables you to identify different areas in which productivity can be improved and, even more importantly, where time and costs are being wasted. In February DenimWorks manufactured 200 large aprons and 100 small aprons. The standard cost of direct labor and the variances for the February 2023 output is computed next. Labor yield variance arises when there is a variation in actual output from standard. Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods.

ABC Company has an annual production budget of 120,000 units and an annual DL budget of $3,840,000. Four hours are needed to complete a finished product and the company has established a standard rate of $8 per hour. The direct labor (DL) variance is the difference between the total actual direct labor cost and the total standard cost.

- Companies should continuously monitor labor variances to ensure that labor costs remain aligned with budgeted expectations.

- If the exam takes longer than expected, the doctor is not compensated for that extra time.

- Project deadlines are becoming tighter, and the rising cost of skilled labor, understanding and improving labor efficiency isn’t just a recommendation.

- Direct Labor Mix Variance typically occurs when the actual labor mix used in production is different from what was budgeted or anticipated.

- It measures the difference between the actual labor costs incurred during production and the standard labor costs that were expected or budgeted.

The difference between the standard cost of direct labor and the actual hours of direct labor at standard rate equals the direct labor quantity variance. In this case, the actual hours worked per box are 0.20, the standard hours per box are 0.10, and the standard rate per hour is $8.00. This is an unfavorable outcome because the actual hours worked were more than the standard hours expected per box. As a result of this unfavorable outcome information, the company may consider retraining its workers, changing the production process to be more efficient, or increasing prices to cover labor costs.

Understanding labor efficiency variance helps companies identify inefficiencies in their production processes and take corrective actions to improve labor productivity. Understanding both labor rate variance and labor efficiency variance is essential for a comprehensive analysis of direct labor variance. During June 2022, Bright Company’s workers worked for 450 hours to manufacture 180 units of finished mm millions definition, examples, what mm means product. The standard direct labor rate was set at $5.60 per hour but the direct labor workers were actually paid at a rate of $5.40 per hour. Find the direct labor rate variance of Bright Company for the month of June. In this example, the Hitech company has an unfavorable labor rate variance of $90 because it has paid a higher hourly rate ($7.95) than the standard hourly rate ($7.80).

By showing the total direct labor variance as the sum of the two components, management can better analyze the two variances and enhance decision-making. Another element this company and others must consider is a direct labor time variance. The actual hours used can differ from the standard hours because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. A favorable labor rate variance suggests cost efficient employment of direct labor by the organization. A labor rate variance is a measure between the total amount paid for labor and the standard amount paid.